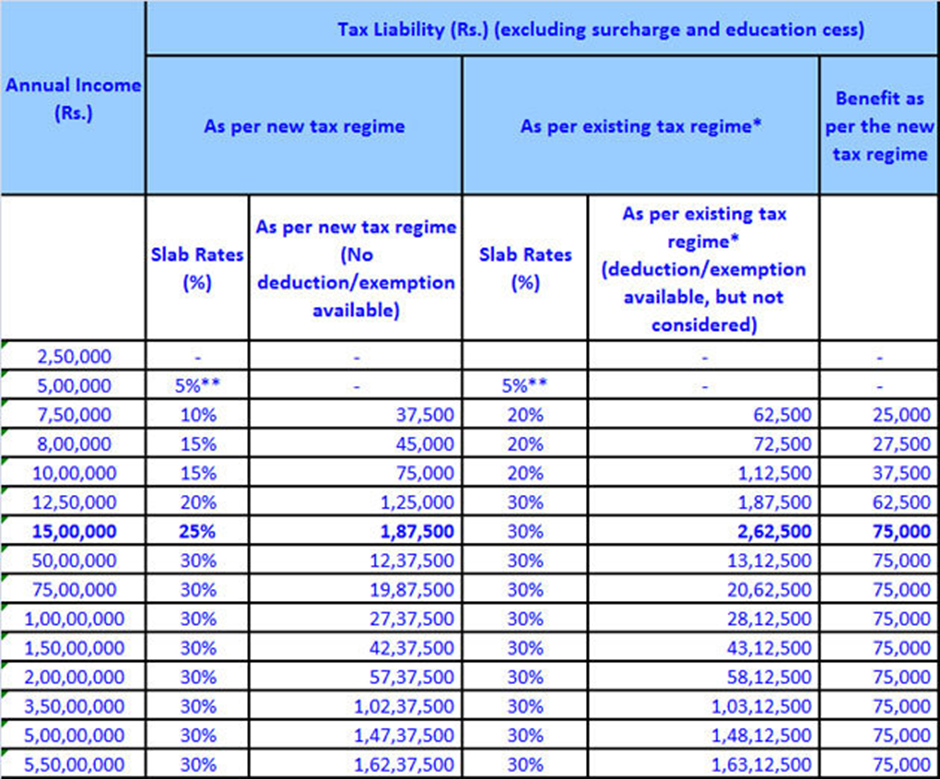

In Budget 2020, the Indian government unveiled a new income tax structure that would be available to citizens starting in FY2021. Its adoption, however, stayed modest. Finance Minister Nirmala Sitharaman revealed a significant change to the new tax structure in the Union Budget 2023 to promote greater adoption. These modifications will take effect for the fiscal year (FY) 2023–2024, also known as the evaluation year (AY) 2024–2025, which runs from April 2023 to March 2024.

In actuality, the new tax regime has been chosen as the default choice for all taxpayers beginning in FY24, and taxpayers who wish to choose the old tax regime must now express this preference in writing.

What exactly is the new tax system, what changes have been made to it, and how does it compare to the prior system now?

Which one should you choose now that the government has attempted to level the playing field between the previous tax regime and the new tax regime? What you should know is as follows.

*In the existing tax regime the basic exemption income slab in case of a resident individual who is 60 years

Deductions and Exemptions Under Old Tax Regime

| Deductions | Exemptions |

| Public Provident Fund | House Rent Allowance |

| Equity Linked Savings Scheme (ELSS) | Leave Travel Allowance |

| Employee Provident Fund | Mobile and Internet Reimbursement |

| Life Insurance Premium | Food Coupons or Vouchers |

| Principal and Interest component of Home Loan | Company Leased Car |

| Children Tuition Fees | Standard Deduction |

| Health Insurance Premiums | Uniform Allowance |

| Investment in NPS | Leave Encashment |

| Tuition fee for Children |

The pros of the old regime:

• The old income tax system encouraged saving by requiring investments in specific tax-saving vehicles over time, which helped people save for a variety of upcoming expenses like marriage, education, home purchases, medical expenses, etc.

• In March 2019, India’s gross savings rate was around 30%, with domestic savings by people playing a sizable role in the country’s overall savings rate.

The cons of the old regime:

• Investments in certain instruments are eligible for tax benefits under the previous tax system, and most instruments have a set lock-in period of three to five years. Millennials, who would rather spend than save, and seniors, who would rather have cash on hand and invest in securities with a flexible and open-ended tenure, may not find this to be an appropriate tax-saving option.